Subscribe to ShahidulNews

By rahnuma ahmed

“I know you are very busy, but you must make time. I have something very important to tell you,” I insisted.

Later, sitting in Nurul Kabir’s office, I asked, did you know that the American Federal Reserve Bank is privately-owned?

Wha-at? No! How?

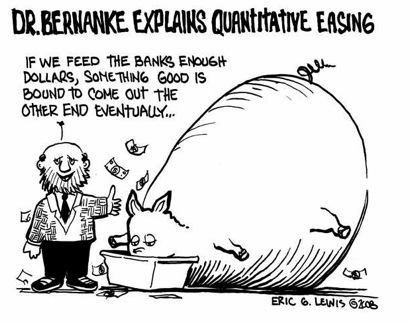

I spilled the beans: the Fed (as its known for short), America’s central bank, is actually not a central bank, its not government-owned, its actually a banking cartel, the American government doesn’t create, doesn’t print money, this banking cartel does it, and the US government is indebted to it, and Americans are taxed to pay off the interest to this cartel, and the interest is just huge, a staggering amount in trillions of dollars, talk of shudkhors (usurers), its an unbelievable scam, American people generally don’t know about it, the media doesn’t talk about it, it’s a huge big cover-up… I went on excitedly till I ran out of words.

A long pause, then I reeled off the names of some leftists, friends we have in common, and asked Kabir, do you think our anti-imperialist friends, very critical of American capitalism, and for good reasons too, know this? The real story?

No, came the immediate reply. Since I didn’t, I’m sure they don’t either. Oooh, how conceited, I yelped, as I took a long sip of tea, which had gone cold as I gabbled. We laughed, and I moved on to describe how I had come across this extraordinary tale.

It was last year, when I had been researching for my `Weaponisation of Weather’ series (Parts I-IX, New Age, February 1, 2010 to April 1, 2010).

I hadn’t gotten around to writing about this most macabre of oddities — a privately-owned central bank — earlier, but as I do so now, I think, what better time than when the Occupy Wall Street Movement spreads across America, when we are reminded by bloggers and activists, that Wall Street and the Federal Reserve System are but two sides of the same coin (`Occupy Wall Street and Occupy the Fed Are Two Sides of the Same Coin’ by Washington’s Blog, October 10, 2011). When slogans are raised, to `End the Fed’.

One of the best books on the Federal Reserve System is by G. Edward Griffin, author of The Creature From Jekyll Island (1994), who says he deliberately chose the title to `catch people’s attention and make them wonder’ whether it was `a sequel to Jurassic Park’ (Interview with G. Edward Griffin, by Victor Thorn and Lisa Guliani, Wing spotlight, April 2, 2004).

But Jekyll Island is a real island, off the coast of Georgia, not the former Soviet Union’s Georgia, but the United States’ southeastern state of Georgia, the `last of the orginal Thirteen Colonies’ which, as American history books inform us, was restored to the Union, in July 1870.

The Federal Reserve System was created on that island in 1910. Under conditions of `extreme secrecy.’ It was this, and the fact that it was not created in Washington, D.C., in `some kind of a committee room’ which you would expect believing it to be `a government agency of some kind’ that made Griffin suspicious. ‘I realized that this was strange.’

To add fuel to fire, Griffin came to learn that in those days the island was privately owned by a small group of billionaires from New York City, people like J. P. Morgan, William Rockefeller, and their business associates. It was a private social club called The Jekyll Island Club, where the families of these very wealthy people went to spend the cold winter months, away from New York, to beautiful cottages, still well-preserved.

`I can assure you,’ says Griffin, `that very few wars of history were plotted under greater conditions of secrecy than this meeting…when something’s done in secret, there’s usually something to hide.’

Why this extreme secrecy? What were they trying to hide from public view? To understand that, one needs to get an idea of the historical context. The Federal Reserve, goes on Griffin, was offered to the voters in 1913, the year it was actually passed into law, as a solution to a problem. In those days, ?Americans were deeply concerned about the `concentration of financial power into the hands of a small group of powerful banking and investment firms on Wall Street.’? Such conglomerations were referred to as the `money trust,’ squarely condemned in editorials.

Warned by men considered its founding fathers as well, for, Thomas Jefferson had said, ‘I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow the banks to control the issuance of their currency, the banks and corporations that will grow up around them will deprive the people of all property, until their children wake up homeless on the continent their fathers conquered’ (from native Americans whom they genocided, but lets leave that aside for the moment).

People were aware that too much power was concentrated into the hands of a few people, and were demanding legislation to `break the grip of the money trust.’ The Federal Reserve Act was offered as a solution to this problem. The first thing that those who attended the meeting were trying to hide was that the Federal Reserve System was written by the Money Trust, that the `fox was building[ing] the hen-house and install[ing] the security system.’

Those who attended the meeting were the `epitome of the money trust.’ They were literally the `wealthiest men in the world.’ According to estimates provided by writers of the time, `these people either controlled directly or indirectly through the banking firms that they represented, approximately one-fourth of the wealth of the entire world.’

Those present at the meeting represented the J. P. Morgan dynasty, the Rockefeller dynasty, Kuhn Loeb & Company, the Rothschilds from Europe, and the Warburgs from Germany and the Netherlands. They created the Federal Reserve System, ‘supposedly, to break the grip of the money trust.’

The extremely secretive meeting, and the consequent agreement, marked a major change. Prior to that, these financial elites were `spilling blood all over the battlefield in New York and Paris and London’ as they struggled for dominance in world markets. But, at the turn of the century, they decided that `since they were at the top of the heap, they didn’t want anymore competition.’ They decided to share the market instead, as `they were looking for new ways’ and settled on forming monopolies and cartels, to go into joint ventures with competing firms so that they would no longer need to compete on price or markets, patents and processes.

The Federal Reserve is a cartel, its a banking cartel `no different than the banana cartel, the oil cartel, or any other.’ Its a banking cartel which means its a partnership between the government and the private banks. The Federal Reserve, as a banking cartel, went into partnership with the federal government because `only governments can enforce the cartel agreements.’ Without the government’s agreement in a cartel, `there’s no way for the cartel members to make sure that the other members stick with the agreement.’

Paul Warburg, born in Germany and a naturalised American citizen, a front man for the Rothschild family, `masterminded’ the Federal Reserve, having had more experience with the central banking mechanism.

The legislation was `shepherded through a carefully prepared Congressional Conference Committee’ which was scheduled to meet between 1:30-4:30 am, `when most members of Congress were asleep’ on December 22, 1913 (Stephen Lendman, The Federal Reserve, June 29, 2006). The Act was voted on the next day, when many members had left for Christmas holidays. Those who had stayed behind, hadn’t had the time to read it, or to learn of its contents. It was signed into law by president Woodrow Wilson who later admitted ‘I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is now controlled by its system of credit. We are no longer a government by free opinion, no longer a government by conviction and by vote of the majority, but a government by the opinion and duress of a small group of dominant men’ (1919).

It is commonly believed that the Federal Reserve System is a `function of government.’ That, it is subject to its control. It is often referred to as `a quasi-governmental, decentralised central bank. All false, says Lendman.

In reality it is ‘a privately held and operated cartel made to look like the government is in charge.’ Being headquartered in Washington, in a formidable and impressive-looking building, is part of the `subterfuge.’ The Fed is composed of a Board of Governors in Washington and 12 regional banks in major cities; it includes many and various member banks including all national banks, which are required to be part of the Fed system. The Federal Reserve began operation in November 1914, a year after the Congressional Act, and was `mandated by law to have the greatest power of any institution in the country ? the power to create and control the nation’s money supply.’

The Federal Reserve Banks of each region, according to the Federal Reserve Act of 1913, are owned by the member banks in it. More subterfuge, as these Fed banks are `privately owned corporations that make a great effort to hide the fact that they, in fact, own what the public largely thinks is part of the public treasury and government.’

The American public, writes Lendman, would be upset if they knew that the Fed Reserve has, like any other business, stockholders who are paid 6% risk free interest every year on their equity holdings. More so, if they knew that some of the owners are powerful foreign investors from the UK, France, Germany, the Netherlands and Italy.

In 1913, the five primary forces were the Morgans, Rockefellers, Rothschilds, Warburgs and Kuhn-Loeb. When asked, which are the dominant forces in the banking industry now, people who really pull the strings of the rest of the world, Griffin replied, `pretty much the same except for one shift.’ In 1913, J. P. Morgan, or the House of Morgans, was the dominant banking force in the United States. Morgan was probably an agent of the Rothschilds, the latter had a `very strong, very effective tactic of doing business through other organizations that were thought to be independent,’ largely due to European anti-Semitism. Being Jewish, they had discovered that if they wanted to gain dominance in a market that was anti-Semitic, they couldn’t do it directly. So, they would work through agents who were `thought to be independent’, in some cases, ones who were though to be anti-Semitic, like J. P. Morgan. But today, the `dominant banking force’ in the US is the Rockefellers. The Rothschilds are still very powerful, but `continue to operate behind the scenes’ (more subterfuge?). `They like the public to think that they’re just a bunch of playboys and they dabble in the markets.’

Concluding part to be published tomorrow.

Published in New Age, Monday, November 14, 2011

Leave a Reply

You must be logged in to post a comment.