Subscribe to ShahidulNews

By Lydia Polgreen

New York Times: January 29, 2011

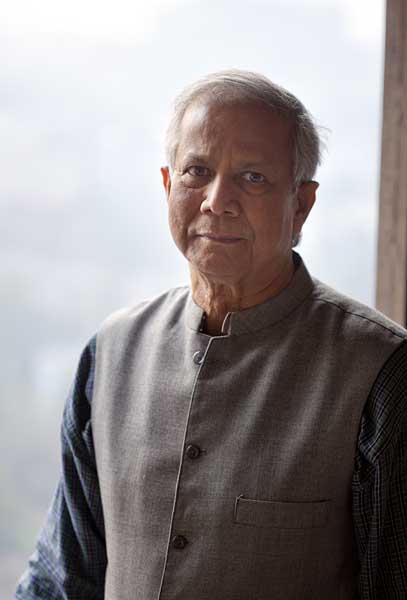

DHAKA, Bangladesh ? Any other year Muhammad Yunus, the Nobel Peace Prize laureate and a pioneer of microcredit, would be in Davos, Switzerland, this week. For years he has been celebrated at global gatherings like the World Economic Forum there for helping move millions of impoverished women toward a better life through tiny but transformational loans.

Instead, he was in court again on Thursday, facing accusations, considered frivolous by most accounts, that one of his nonprofit companies adulterated vitamin-fortified yogurt. On Jan. 18, he was summoned to a rural courtroom to face charges of defamation lodged by a local politician.

Microcredit, the idea that Mr. Yunus popularized as a path out of penury for those long excluded from the banking system, has increasingly come under scrutiny. Scholars have cast doubt on its effectiveness in fighting poverty, and politicians and other critics accuse microfinanciers, many of whom, unlike Mr. Yunus, profit from the loans, of getting rich off the poor.

Now, the government of Bangladesh has ordered a wide-ranging inquiry into the microfinance institution he founded 34 years ago, Grameen Bank, after a Norwegian documentary accused him of mishandling donors? money. Norway?s government has said no money was misused. Still, Mr. Yunus?s troubles will deepen what has become a global crisis in microfinance that threatens to undermine the very concept ? small loans to poor people without collateral ? on which his reputation rests.

Long accustomed to adulation at home and abroad, suddenly, at 70, Mr. Yunus, Bangladesh?s best-known citizen, finds himself very much on the defensive. In an interview at his office here, Mr. Yunus seemed stunned and deeply stung.

?There is some kind of misinformation,? he said, his voice trailing off. ?I shouldn?t say more.?

A pause.

?Every word I say will be held against me,? he said finally.

On one level, his troubles seem to be largely political. Mr. Yunus, who leads a spartan life, has for decades floated well above the muck of Bangladeshi politics. Then in 2007, while a caretaker government backed by the military ruled Bangladesh, he waded in, egged on by supporters who argued that his leadership was needed in a time of crisis.

He declared in an interview that Bangladeshi politics were riddled with corruption. He floated a short-lived political party. Bangladesh?s political class did not take kindly to being lectured by the Nobel laureate. The steely leader of one of the main political parties, Sheikh Hasina Wazed, took umbrage, analysts say.

In the 2008 election that restored democracy after a two-year interregnum, Ms. Hasina led her party, the Awami League, back power with a vast majority. Her critics say that in lashing out at Mr. Yunus she is simply trying to eliminate a political rival.

But lost in the talk of politics is a more complex question: how to ensure that Grameen Bank, which has 8.3 million borrowers, has loaned $10 billion and has become an indispensable part of Bangladesh?s social and economic fabric, outlives its charismatic founder? Mr. Yunus is now a decade beyond the bank?s mandatory retirement age, and apparently there is no successor in sight.

Long-serving internal candidates that might have replaced Mr. Yunus as the bank?s managing director after his retirement have departed acrimoniously.

The government recently appointed one of his former deputies, Muzammel Huq, as chairman of the board. Mr. Huq has been a vocal critic of Mr. Yunus, and the promotion of a former underling has been taken as a sure sign that the government seeks to oust the bank?s founder.

?I think he is a good man with a small heart,? Mr. Huq said of Mr. Yunus. ?He cannot give credit to anyone but himself,? he added, with a wan smile at his pun.

Microfinance experts worry that a government takeover of Grameen Bank may turn it into a tool of political patronage and destroy it. Mr. Yunus said that he was eager to step down, but that the transition must be handled carefully to avoid panic among borrowers and the bank?s employees.

?I am riding the tiger,? Mr. Yunus said. ?I cannot just get off the tiger without drawing the attention of that tiger. So I have to very quietly do it.?

The Norwegian documentary accuses him of improperly moving $100 million that has been donated by Norway for microcredit to another Grameen nonprofit organization. The Norwegian government later confirmed that the money had been improperly moved, but it cleared Grameen of any wrongdoing.

?There is no indication that Norwegian funds have been used for unintended purposes, or that Grameen Bank has engaged in corrupt practices or embezzled funds,? Erik Solheim, the Norwegian minister for environment and international development, said in a statement.

Related

Bangladeshi government officials say they are worried that the handling of the Norwegian money may point to broader problems at Grameen. Mahbubul Mokaddem Akash, an economist at the University of Dhaka who has been critical of Grameen Bank, said that while Mr. Yunus might be personally incorruptible, the bank needed strong governing practices and transparency if it was to thrive once its charismatic founder departed.

?The main focus should not be on personal corruption but on prudential management of the institution,? Mr. Akash said.

Grameen Bank is different from private microfinance companies that have come into disrepute in recent years, accused of charging exorbitant interest rates and being too aggressive in making loans and collecting payments. Grameen is owned largely by its borrowers, who share its profits. The Bangladeshi government owns 25 percent of the bank and appoints two board members and the chairman of the board.

The board is largely made up of poor, uneducated women who are Grameen borrowers. They lack the skills and experience to oversee its complex operations, critics say. Mr. Yunus has tried, unsuccessfully, to get himself appointed as chairman of the board so that he could continue to oversee the bank after retiring from running it. The government has refused.

But questions about how Grameen Bank operates have been drowned out in the acrimonious, deeply personal politics of Bangladesh. Ms. Hasina, who had been a supporter of Grameen and microcredit, accused microfinance lenders in December of ?sucking blood from the poor.?

Ms. Hasina has long resented Mr. Yunus?s success, analysts here say, worried that he will emerge as a political rival. As early as 1996, when Ms. Hasina became prime minister for the first time, she wanted to reduce the independence of Grameen Bank and its founder, according to a senior bureaucrat who worked for her at that time.

?She wanted a shuffle of the bank?s leadership,? the bureaucrat said, speaking anonymously for fear of retribution.

It got worse when Mr. Yunus received his Nobel Peace Prize in 2006. With the main opposition party, the Bangladesh National Party, divided and weakened, Ms. Hasina had come to see him as a major political threat.

?She is afraid that another military government will come and try to use Yunus as its face,? said a retired senior government official who worked closely with Ms. Hasina but who feared being punished if identified. ?She wants to tarnish his image so that he becomes less of a threat.?

But Mr. Yunus?s supporters are upset that his legacy, so carefully built over decades of serving the poor, has been so swiftly called into question.

?This man has done so much for the country,? said Mahfuz Anam, editor of The Daily Star, a leading English-language newspaper. ?He does not deserve to be treated this way because of dirty politics.?

Leave a Reply

You must be logged in to post a comment.