It was 1988. The flood waters had reached Dhaka, and I needed a boat to get to the head office of the Grameen (Rural) Bank. A soft spoken unassuming gentleman, casually clad, sat at a plain wooden table. There was no air?-conditioning and the fresh breeze flowed freely through the open windows. My posh camera seemed quite out of place here.

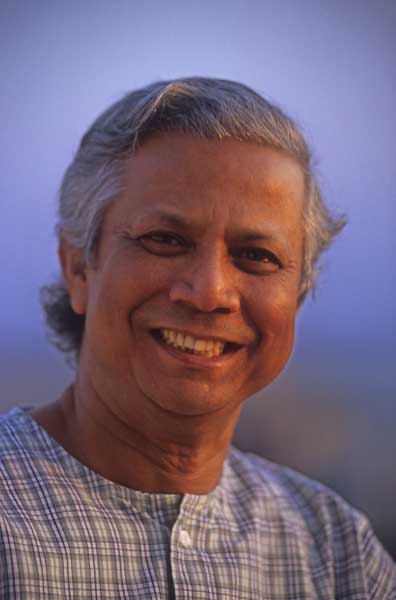

Dr. Muhammed Yunus shook my hands warmly and words flowed easily from the man who had created one of the most remarkable organisations in banking history.

The Grameen Bank gave money only to the poor. Loans to the landless were interest free. None of the debtors had collateral. 75% of the bankwas owned by the landless who could purchase shares of Take 100 (about two pounds; each in 1988. Only one share was allowed per person). The bank boasted 346 branches and 3,000,000 members, 64% of whom were women. Incredibly, about 98% of the loans were returned! It was rapidly expanding and by the following year, Yunus hoped to have 500 branches.

An economics graduate from Vanderbilt University, Yunus had been teaching at Tennessee State University when war broke out in Bangladesh in 1971. He got actively involved in the liberation movement and returned to the newly created nation in 1972 and took up teaching at Chittagong University.

The famine in ’74 touched him deeply. The sight of the dying in the streets made him question the validity of the economic theoories that he espoused. During this soul searching he mixed intimately with the villagers and learnt of their habits, their values and their problems. One of them was a woman who made Moras (bamboo stools). She was skilled and conscientious and worked long hours. He was appalled when he discovered that she earned only eight annas (about one pence) for her daily labour! Angered and dismayed, he sought out the reasons for this shamefully unfair setup.

It had long been claimed that laziness, lack. of skill, and extreme conservativeness was the root cause of poverty in Bangladesh. Here was a woman who was skilled, worked extremely hard and had taken the initiative of setting up a business for herself and was still being cruelly exploited.

She did not have the money to buy the bamboo, so she had to borrow from the trader. He paid a price for the finished stool which was barely the price of the raw materials. She ended up with a penny a day!

With the help of a student Emnath, Yunus made up a list of 42 people who worked under similar conditions. He paid out their total capital requirement of Taka 826 (less than a pound per head) from his own pocket. It was a loan, but it was interest free.

Aware that this was not the real solution to the problem, Yunus approached his local bank manager. The man laughed. The idea of giving money to the poor, and that too without collateral, was to him hilarious. Undeterred, Yunus approached the assistant general manager of Janata Bank:, Chittagong. The manager was encouraging,, but felt that in the absence of collateral, a guarantee by influential people in the village would be necessary. Yunus realised that this would eventually lead to some sort of a slave trade. The bank was adamant, and eventually he talked them into accepting him as the guarantor. The manager was reluctant in the beginning, but felt he could take the risk, the sum being so small.

The system worked, all the loans were repaid and more people were offered loans. Yunus suggested that it was time the bank took over the responsibility themselves and lent out money directly to the villagers.?So I tried to establish that this could be done as a business proposition. I became vocal against the banking institutions, arguing that they were making the rich people richer and keeping the poor people poor through something called collateral. Only a few people could have access to funds. The bankers were not convinced.

Finally they challenged me to do it over a whole district, not just a few villages. They said if I could do it over a whole district, and still come back with a good recovery, then they would reconsider. I accepted their challenge. They asked me to go far away, to where people would not recognise me as a teacher but would instead think I was a banker. So I went to a far flung district in 1978, and started working there.”

It worked beautifully. They had almost a 100% recovery. The small loans made a big difference to the people, but the banks still dragged their feet. Yunus realised that if he went back to the University, the project would die. He suggested the formation of a new bank. One owned by the people themselves. The banks were skeptical, but he got a lot of public support, and eventuual1y in October ’83, an independent bank called the Grameen Bank was formed.

Dr. Yunus is modest about his own contribution. Asked if the bank would survive without him, he smiled “Look at what we have achieved, could it ever have been possible without dedication at all levels ??

There is a more important reason for the bank’s survival. Contrary to most other viable commercial banks, this one is truly designed to serve the people.

Always quick to accept innovations, Professor Yunus was the first person to order an email account when we set up Bangladesh’s first email service in the early nineties. He was user number six, the first five accounts being Drik’s internal numbers. Later he ordered the entire Grameen office to be networked and had generic email addresses issued to key personnel.

The bank now has nearly six and a half million members, 96% of whom are women. The $ 5.3 billion given out as loans and the $ 4.7 billion recovered are figures any commercial banker would be proud of. Since then other Grameen entities under the more recently formed Grameen Foundation have been born. Grameen Phone, a highly successful telecommunications company has provided phones to rural women, many of whom have become successful entrepreneurs. However both the Grameen Bank and micro-credit have had critics. The high rate of interest is seen to be exploitative by many. There have been accusations that the methods of recovery, often by overzealous bank officials, have led to extreme hardship.

The skyscraper that now houses the bank, many feel, distance it from the poor it represents. The close links with Clinton and Turner, and the uncritical position taken by Yunus in his public interactions with them, has also been viewed with suspicion. Yunus makes light of these observations. Regarding the criticism of his model, he has a simple answer. ?I make no claims to having a perfect system. The problem has to be solved. Should someone come up with a better solution, I would happily adopt it.?

Bangladesh has largely been known for floods famine and other disasters. Yunus has provided Bangladesh with a pride it badly needs. Many had hoped that he would enter politics, providing an alternative to power hungry politicians that people have lost trust in. While he has steered away from mainstream politics, Yunus was an adviser to the caretaker government. That this popular teacher turned banker should be the Nobel Peace Prize winner in 2006 is a source of great joy to Bangladeshis, but an honour they feel was long overdue.

(Photo by Munem Wasif / DrikNEWS)

Shahidul Alam

Drik Picture Library Ltd.

Dhaka 1988 and 2006

High resolution photographs available from Drik Picture Library: library@drik.net

and DrikNews: driknews@gmail.com, driknews@yahoo.com

15 thoughts on “Bank for the Poor”

Leave a Reply

You must be logged in to post a comment.

Thanks for such a detailed perspective on one of Bangladesh’s few deserving youth idols. Google bots as well as the imaginary international image of Bangladesh will be very impressed with your post 🙂 Although , the top-most image is probably too big for the actual span of the content-column, and thus its overlapping other sidebar items 🙁

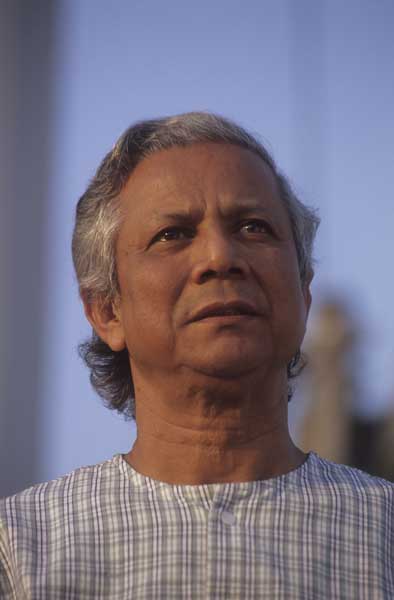

One more thing, the very last image of (now a legend) Dr Yunus makes him look evil and bent on world domination, he has tons of other snaps which can really portray the vigor and solemness his character actually possesses. Its just a suggestion from a random reader thats all.

Now rejoice 😀

Shahidul, when I heard the news over the tv yesterday, I was wondering how I could post on your site to congratulate you for your fellow countryman winning the nobel peace prize. I smiled when I received your mailing list this morning.

In the competitive world of today where people only think of serving themselves first in their rush to get ahead, it is indeed heartwarming to read about a man who only had thoughts of serving the poor.

Yes there can be no peace unless the war against poverty is won.

His concept of teaching the poor to help themselves and giving them a head start in small doses is fantastic. What a way to advance democarcy and human rights.

In my country they give fish to the poor instead of teaching them to fish. Those in power only think of how to make themselves richer. Nothing is done for the poor. Hence, after almost 50 years after independence, there is no improvement… only massive corruption and a non-transparent government which clamps down on dissent. We are being plundered by the previlaged few, leaving crumbs for the marginalised majority. Sorry for digressing Shahidul.. I had to get this out 😉

Best regards,

–omar from kuala lumpur

Great article, best one I’ve read these past 2 days!

thought of you when i read this in the papers! really do wish we have the same people in manila…

rj- from philippines/uk

Thank you Shahidul, for the best story on Dr. Yunus I have read so far. It really humanizes him and explains his mission beautifully. May God bless him for excellent work.

Ya Haqq!

Dear Shahidul,

What a wonderful man – what a face he has. As always, I may rely upon you to provide me with insights I might never otherwise be privileged to encounter. The photographs you select for your posts on these compelling stories, are just stunning. They have such impact.

Thank you.

Kind regards,

Patricia

I discovered this story rather in the way of serendipity – this is a tidily-written and beautifully illustrated article, for which I thank you. The idea of the bank deserves spreading afar, for there are poor, economically abandoned people here in South London too and they might well approve – if they’re ever allowed to know of it …

Power to your elbow!

Excellent article, the most-nicely illustrated one I’ve read among them all. It’s not just a matter of pride and joy for Bangladeshis, but a soul-awakening call that it’s about time WE step forward and try making differences ourselves. It’s not just a Nobel Peace Prize, but something that should give every aspiring visionarian in this country a new-found confidence to MAKE THINGS HAPPEN. It’s NOT impossible, not beyond our reach.

Congratulations, on behalf of the young minds and “future leaders”.

i am an educational technologist developing an online learning environment using constructivist approach using grameen bank as a case study, i wish grameen bank all the success

Luogo interessante, buon disegno, lo gradisco, signore! =)

NOBEL-MAN?S UN-NOBLE CORPORATE NEXUS

by

Omar Tarek Chowdhury

Dr. Muhammad Yunus, the self-proclaimed ?banker to the poor?, has been awarded Nobel Peace Prize 2006 and following the announcement of the award mainstream media created an euphoria throughout in Bangladesh. The mainstream academia has also jumped on the bandwagon. The unrestrained wave of delight created by the mainstream of society representing the ruling class in the wake of Yunus’ adornment with the coveted prize, has given it a ploy to camouflage its hollowness, intellectual shallowness and failure to govern the society it dominates. This ruling class is rotten to the core and morally and intellectually bankrupt. No wonder that in the era of neo-liberalism the opinion-makers and the dominant media, controlled by capital as they are, will be hyper-active to make people forget their woes and ?feel good?. The award has provided a very good opportunity to them. The merriment-deluge washed away the sense of necessity that makes one analyze the significance of this world famous laurel which has been bestowed upon the founder-head of the Grameen Bank (GB).

Except a very few skeptics none will disagree that no other person has been adorned with so many awards and honorary degrees than Dr. Yunus, the teacher-turned-banker. The person advocating credit for the poor has so far won 68 awards, 28 honorary degrees and 15 felicitations from his motherland and other countries. Along with him the GB, his much acclaimed creation, has been awarded 8 national and international awards including Nobel Peace Prize 2006. These are, in a real sense, a recognition of his efforts to contain the poor in a way that helps to maintain the status quo and identify an effective alternative institutional method for profitable investment of finance capital. So, the mainstream policy-makers have come to recognize the merit of this method. The method devised by him has proved effective to all concerned ranging from the UN poverty-crusaders to the Citibank, from the promoters of technology-not-friendly-to-environment to the finance capital investors. These ground realities made it necessary for a wide range actors to construct a mythical image of Dr Yunus and in doing so there was an avalanche of awards, honors, etc., for him, an unending supply of chairs in the boards of ‘independent’ and ‘not for profit’ foundations floated and supported by multinational corporations (MNC). Reports with illusory images of his warm friendship with kings and queens and presidents and first ladies were circulated giving the impression of a fairy tale of friendship between a prince and a ‘pauper-son’. The target for these image-bombardments was the psycho-world of the common people. The corporate controlled pundits, media and opinion-makers have ‘illuminated’ the psycho-world of common people with illusions and high pitched propaganda to drain people of their reasoning, the power of questioning and the capacity of digging out truth. Sometimes the power-owners appear successful, at least for the time being. Relying on his magnified image Dr. Yunus has successfully become a broker in the world of international finance capital, in the marketing of technology and in the mainstream political economy. (It should be mentioned that brokering, lobbying, etc. are recognized and dignified professions in the western world.) Muhammad Yunus has been and is being awarded repeatedly for efficiently acting as a broker on behalf of big corporations of the west and as a chain reaction one award has attracted another.

No award is politics-,economics-,philosophy-, and ideology-neutral. While discussing an award it is worthwhile to take stock of the organizations or persons behind it, to whom it is awarded, and the reasons behind not awarding it to some other person than the one who has been tipped for it. Joseph Stalin was nominated for the Nobel Peace Prize but was not awarded it. Jean Paul Sartre, and in the near past, Arundhati Roy, the defiant voice, refused the Nobel Prize and Sahiyata Academy Award of India respectively. All these facts demand an analysis. Dr. Yunus was awarded the World Food Prize, known as the Alternative Nobel Prize, in 1994 and the prize is patronized by 74 organizations including the ‘famous’ US agri-business company Monsanto, Cargill and other US large soyabean and farm products exporting companies, the Agriculture Research Service of the US government, a number of financing companies and the ‘famous’ Coca-Cola. Yunus took initiative to float a joint venture company to market harmful agricultural technologies (genetically engineered seeds, Roundup herbicide, ?transgenic? or ?genetically modified? plant species) of Monsanto, a company despised in the west, in Bangladesh after being bestowed with the Alternative Nobel prize. Even US $150,000 was accepted by him to set up Grameen Monsanto Center for Environment-Friendly Technologies. This ‘pious’ act of brokering was initiated during the second micro credit summit. Monsanto in its zeal to send ‘poverty’ to a museum approached Dr. Yunus, would be curator of ?poverty museum?, and he did not hesitate to collaborate. An adventure indeed! But he was later compelled to make a retreat with ‘dignity’ following a flurry of criticisms from different parts of the world by the environmentalists. However, the former university teacher offered no explanation to the members of the public, not even to his constituency — the poor in Bangladesh. Probably highly innovative minds need not engage in ‘petty’ acts like offering public apology for making profit at the expense of the environment and food security of the country. Nor do the poor have the opportunity to map the minds that win friendship of MNCs and kings and queens. But a number of personalities and organizations should be acclaimed for compelling the Nobel-man retreat and they include Vandana Shiva, the philosopher and environment activist; late AZM Obaidullah, a famous Bangali poet; and Nayakrishi Andolon, a movement for ecology-friendly agriculture in Bangladesh. The now-futile venture of the microcredit evangelist is a stark example of harming the agriculture of his motherland, endangering food security, creating dependency, and all these mighty tasks were planned to be initiated by offering ‘free’ technology through microcredit, the ‘panacea’ for the poor. The myth of ‘telephone ladies’ has been created with the same tact. These ‘simple’ acts tell the intimate tales of the friendship between the poor?s banker and the mighty rulers, and help to explain reasons why the corporate owned media and the pundits, who are ideologically linked, are untiringly singing the same mantra, propaganda and gospel to build up the cult of the banker for the humble. An in-depth enquiry will show that many of the individuals and organizations engaged in this campaign are connected to each other through business and financial concerns. The link here is, also, finance and business. Just as the World Food Prize was related to the marketing of Monsanto-technology among the farmers of Bangladesh, the One World Broadcasting Trust Media Award (1988) and the World Technology Network Award (2003) from Britain, the Telecinco Award (2004) from Spain, connected to marketing of mobile phone, the Economist Innovation Award (2004) and the Leadership in Social Entrepreneurship Award (2004) from the US and many other awards were meant to expand corporate business interest. The German telephone giant Deutsh Telecom and the US software giant Microsoft are the patrons of the Petersberg Prize which was awarded to the Grameen Bank in 2004.

Dr. Yunus has received the Seoul Peace Prize from Korea a few days after he had been awarded the Nobel Peace Prize. Before he left for Seoul and after his return from there he did not forget to advice the caretaker government, mainly responsible to organize national election during its 90 days tenure, to take a quick decision on opening the Korean Export Processing Zone (EPZ) in Bangladesh.

It seems that formal functioning of the Korean EPZ is the top priority of the friend of the poor as MNCs have unrestrained liberty to plunder the natural resources of the country under the guise of foreign investment, as corruption, kick backs and absence of transparency is the norm in these deals, and as many people in this country about half-a dozen poor villagers shed their lives to safeguard the rights of people on the Fulbari coal mine in the northern Bangladesh; as the people of the country do not know the consequences of the agreements with companies like Asia Energy, which was awarded with the Fulbari coal mine on terms highly unfavorable to Bangladesh. It is interesting to note that though there are awards for those who can help the MNCs to maximize profit, there is none for advocacy work to create pressure and realize compensation for the irreparable loss of natural resources due to MNC operation. For example, there has been no award for anyone protesting against the damage done to gas and to bio-diversity by MNCs in the Magurchhara and the Tengratila gas fields, in north-eastern Bangladesh, which blew out due to their callous handling of the well-digging work. There has been no prize for advocacy work to safeguard people’s rights and environment in the Fulbari coal mine and its surrounding areas, there is no patron to support lobbying work in Washington D.C. in favor of the female workers in the garments factories who need safer working condition so that no worker has to be killed in fire accidents in the factories.

It is known to all that huge amounts of fund necessary for education and research in the universities in the west are often provided through grants, assistance, investments, etc. by many Foundations and Endowments set up by MNCs. Such donations obviously influence the activities of these universities. These financial supports influence, directly and indirectly, the ideology of the faculties, the boards of directors, the boards of regents, etc.; the decision-making process; curricula; and areas and subjects of research in the universities. The MNCs efficiently manipulate these bodies and process to advance their own interest. Awarding honorary degrees is an old tactic to build up someone’s image or to polish someone’s palm. There are precedents of awarding honorary degrees to despised and despotic rulers from different countries. Compared to those instances awarding Dr. Yunus scores of honorary degrees and awards seems to be ‘small, innocent’ act. However, there is a need to remain awake to the ramifications of such awards and honors instead of naively looking at them the as the ‘recognition of a person?s extraordinary contribution?.

Muhammad Yunus was selected as one of the ”25 most influential businessmen in the world in the last 25 years.” Wharton School of Business made this selection in 2004 for a documentary made for the Public Broadcasting System (PBS), US. The rich and powerful tycoons in the list included Bill Gates, George Soros, Oprah Winfrey, Jeff Bezos, Richard Branson, Warren Buffertt, Michael Dell, Alan Greenspan, Lee Lacocca, Charles Schwab, Frederick Smith, and Sam Walton. The image of Dr. Yunus that has been built up gradually as a friend of the poor is, apparently, not in accordance with these rich people. Then, there comes the big question: what is the below-the-surface reason for his inclusion in this group of moneyed people? Is it a mere whim of a leading business school? But an analysis of the politico-economic factors brings forth a different answer: the efficient performance of Dr. Yunus as a new pathfinder for the investment of capital, as a broker and salesman of technology is the actual reason for his getting selected by the corporate circle as one of the 25 most influential businessperson in the last quarter century. The capacity of the Grameen Bank in this area is what has prompted the corporate circle to make its decision correctly.

A few more examples will help to show the close deals between Muhammad Yunus and the corporate world. He is a member of the advisory body of the Stockholm Challenge, the global network of the entrepreneurs of information and communication technology. The other members of the board include the senior vice-president of the chief research and science office of the San Microsystems, one of the leading computer companies; the president and CEO of Ericson; a member of the European parliament; a leading entrepreneur of Russia, Western Europe and the US. This list is enough for anyone to understand that safeguarding corporate interest, instead of pushing back poverty to a history museum is the main objective of this corporate network.

Dr. Yunus is co-president and a member of the advisory board of PlaNet Finance (PF), a French organization for financing microcredit programs. Sanofi-Aventis, a multinational pharmaceutical company, is one of the financing patrons of PF. Should anyone believe that Sanofi-Aventis and other multinationals are so eager to eliminate poverty from the face of the earth? One may pray that their eagerness should not be like that of Monsanto. If they are a bit less enthusiastic about poverty elimination that would a favor to the poor.

Dr. Yunus, as a member, adorns the advisory board of the Holcim Foundation, ‘independent of business interest? established and run by one of the biggest cement and construction material producers in this poverty-ridden world. The Swiss company’s revenue in 2000 was US $ 8.2 billion. A look at the activities of the Rockfeller and Ford Foundations that have been criticized and condemned by many will help understand the reasons behind establishing such foundations and the type of activities they often carry out.

Apart from the close connections and deals with the MNCs Dr. Yunus has an organizational structure to turn microcredit into a vehicle for the investment of capital and marketing of technology producedby the MNCs. The Grameen Bank acts as a brand name or a franchise. Microcredit programs, broadly designed after the Grameen model are now being run in more than 100 countries, in continents east and west, in the north and the south. While Bill Clinton initiated it in the US state of Arkansas, the Reserve Bank of India, ‘inspired’ with the neo-liberal ideology, has liberalized their rules so that the program can be introduced among the starving tea farm workers in north-eastern India and among the poor in south India. It is a single string tying all: finance capital, the idle-capital seeking interest.

The Grameen Foundation USA (GFUSA) was established in 1997 to propagate and to expand the activities of interest seeking finance capital among the poor. Dr. Yunus is one of the founder-members and board members of this Foundation, a strategic partner of the GB. This Foundation has now spread out its credit net over 7 million breathing souls in 22 countries through 52 networks. This Foundation invests finance capital among the poor through its marketing of telephone, and through its window of microcredit which is financed by the capital market and commercial banks. It is closely connected with the Citibank, one of the largest financing organizations in the world. Along with Dr. Yunus, some former or present executives of Kane Property Company, GuideStar, Citibank, Microsoft, Citigroup, Calvert Funds and similar other large corporations and financing organizations are on the board of this Foundation. One can guess the power and brokering capacity of this Foundation from the fact that it is closely connected with the Clinton Global Initiative from the days of its inception. Former US president Clinton recommended Yunus for the Nobel award in 2005 for the second time though this move of Clinton went beyond all norms. Because Clinton was not empowered to make such a recommendation as Amartya Sen had been. While this act of recommendation was under way the GFUSA and Citibank joined hands as partner of the Clinton Initiative to jointly invest US $ 50 million and, if possible, $ 300 million, as microcredit. This Foundation has a special role in mobilizing capital, expanding GB-model micro credit all over the world, building up image of microcredit and its guru, and making public relations work. There is a similar type of power brokering house of Dr. Yunus in Australia to mobilize international power.

Undoubtedly, Dr. Yunus has become a blue-eyed boy of the corporate world for his excellent performance and innovations in the field of investment and marketing of finance capital and technology among the poor through microcredit. The third world is not a risk-free area for investment. The defaulting industrialists in Bangladesh are a stark example of this. There are other relevant questions that need to be addressed before an investment is made. The risk of socio-political upheavals in the country in question, the carrying capacity of the economy, the market size, etc. demand serious attention. Dr. Yunus has a ‘magic wand’ that creates an ensured market, an ensured return, an almost full return of the capital, an instant return, and all these he has done with his ‘panacea’ — microcredit. This is what makes him dear to the corporate world and the corporate world is paying him back with laurels, awards, honors, etc. and facilitating his job by building up a larger-than-life image of the salesman. Thus, the underfed, undernourished multitude is fed with the fairy tales of friendship between the ‘banker to the poor’ and the spellbound kings, queens, presidents and first ladies. The Nobel Peace Prize to Dr. Yunus has reaffirmed this fact only.

P.S.: Patrick Bond (Director, Centre for Civil Society (South Africa) and author of Looting Africa: The Economics of Exploitation) repored in the South African daily The Mercury (Oct. 25, 2006): ?So why then did Norway?s Nobel committee give Yunus the award? Colleagues in Oslo point out to me that he was strongly supported by friends in the Norwegian elite, including a former top finance ministry bureaucrat and leading officials of the national phone company, Telenor, which owns 62% of lucrative GrameenPhone, a company in control of 60% of Bangladesh?s cellphone market.

———

Note:

1. Websites: Grameen Bank, GFUSA, World Food Prize, Clinton Initiatives, Holcim Foundation, PlaNet Finance, Monsanto, GAIA Foundation, Stockholm Challange, Nobel Prize, natural-law

2. British agriculturalist Mark Griffiths? letter to Dr. Muhammad Yunus, (June 29, 1998)

3. Vandana Shiva?s E-mail to Dr. Muhammad Yunus, (July 4, 1998)

4. Briefings of Rural Advancement Foundation International (RAFI), Canada and USA

5. BBC report on termination of Grameen-Monsanto deal. July 27, 1998

6. ?Gene firm tightens grip on food chain? by Louise Jury. The Independent (UK), 16.8.98

7. ?Unmasking the microcredit success lie? by Patrick Bond. The Mercury (SA), 25.10.06

—————————————————————-

Omar Tarek Chowdhury (tarekomar@agnionline.com) translates pro-people political literature and contributes to alternative periodicals and newspapers.

I feel that if the risk can be taken in a third world country that the same risk can be taken in the United States. Most politicians claim to have an idea for change to help balance our national budget while we have Americans that do work 60-70 hours per week that do not even know how to balance their own budget. These are not Americans that are lazy these are simply hard worken Americans with not time to budget which lead to dependecy on credit cards which in turn leads to false indicators regarding America’s spending.